The Life Insurance Corporation of India (LIC) offers a range of pension schemes to help individuals secure their retirement years. LIC Pension Scheme is a popular investment option that provides regular income to policyholders after they retire.

A deferred annuity plan allows policyholders to build a corpus over a specific period by making regular payments and then receive a guaranteed pension for the rest of their life. The scheme offers flexibility in terms of payment frequency and pension options.

Policyholders can choose between immediate and deferred annuity options, depending on their retirement goals and financial situation. The LIC Pension Scheme is designed to provide individuals with financial security and peace of mind during their retirement years.

With the increasing life expectancy and the rising cost of living, it is essential to plan for early retirement, and the LIC Pension Scheme is an excellent investment option. Now Let us move further to learn more features about this topic.

What Is LIC?

LIC, or Life Insurance Corporation of India, is a state-owned insurance and investment company in India. Founded in 1956, it is one of the largest life insurance companies in the world, with over 250 million policyholders and a market share of around 70% in India’s life insurance sector.

The company offers a range of insurance and investment products, including term plans, endowment plans, ULIPs, money-back policies, and pension plans.

LIC has a pan-India presence, with over 3,000 branches and over 1 lakh employees. It has been instrumental in promoting insurance and financial literacy among the masses, particularly in rural areas of the country. LIC’s products are designed to cater to the diverse needs of its customers, ranging from protection, savings, and investment to retirement planning.

LIC’s success can be attributed to its customer-centric approach, strong distribution network, and robust investment portfolio. The company has consistently delivered excellent returns to its policyholders, gaining their trust and loyalty. LIC is also known for its ethical business practices, transparency, and timely payment of claims.

Over the years, LIC has introduced several innovative products and services to cater to the changing needs of its customers. Recently, it has embraced technology and digitisation, making it easier for customers to access its products and services online.

LIC has expanded its presence beyond India and operates in several countries, including the United Kingdom, Mauritius, and Sri Lanka. However, LIC is a trusted and reliable brand in India’s insurance and investment sector. Its commitment to customer satisfaction, strong distribution network, and innovative products have made it a market leader.

With its continued focus on technology and customer-centricity, LIC is poised to maintain its leadership position and provide financial security to millions of Indians for years.

Advantages Of LIC Pension Scheme In India:

LIC Pension Scheme is a popular investment option in India that offers several advantages to individuals planning for retirement. Here are some of the advantages of the LIC Pension Scheme:

- Guaranteed Pension: The LIC Pension Scheme provides policyholders a guaranteed pension for the rest of their lives, ensuring financial security during retirement.

- Tax Benefits: Policyholders can avail of tax benefits on the premium paid under the LIC Pension Scheme, per the prevailing tax laws.

- Flexibility: The scheme offers flexibility regarding payment frequency and pension options. Policyholders can choose between immediate and deferred annuity options and opt for monthly, quarterly, half-yearly, or yearly payments.

- Inflation Protection: The LIC Pension Scheme offers inflation protection, as the pension amount increases yearly based on the prevailing inflation rate.

- Death Benefits: The scheme offers death benefits to the nominee in case of the policyholder’s untimely demise, ensuring financial security for their dependents.

- Regular Income: The scheme provides a steady income stream to policyholders during retirement, ensuring financial independence and peace of mind.

- Competitive Returns: LIC Pension Scheme offers competitive returns to policyholders, making it an attractive investment option for retirement planning.

- Loan Facility: Policyholders can avail loan facility against their LIC Pension Scheme policy, subject to the terms and conditions of the policy.

- Surrender Value: The policy offers a surrender value if the policyholder decides to exit the policy before maturity, ensuring liquidity.

Overall, LIC Pension Scheme is an excellent investment option for individuals planning their retirement in India. With its reputation for reliability and trust, LIC Pension Scheme is a popular choice among policyholders in India.

Application Procedure Of LIC Pension Scheme:

Individuals can apply for the LIC Pension Scheme both online and offline.

Offline Application:

- To apply offline, individuals can visit the nearest LIC branch and submit the application form and the required documents.

- The application form can be obtained from the LIC branch or downloaded from the LIC website.

- The required documents include proof of identity, address, and age proof.

- Once the application is submitted, LIC will verify the documents and process the application.

Online Application:

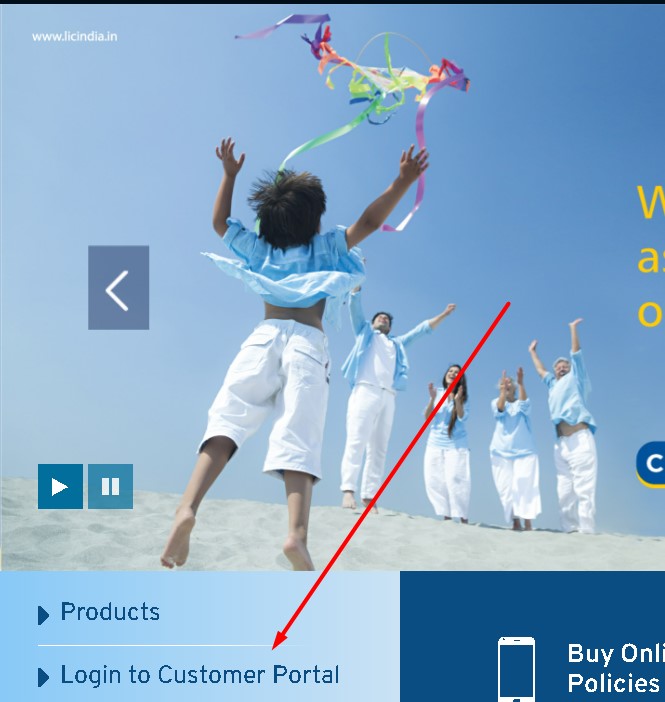

- To apply online, individuals can visit the LIC website( https://licindia.in) or use the LIC mobile app to apply for the pension scheme. They must register on the website or app by clicking on ‘Login to Customer Portal’ at the left side of the homepage.

- Then they are directed to a page with two options, i.e. registered user or new user. One should click accordingly.

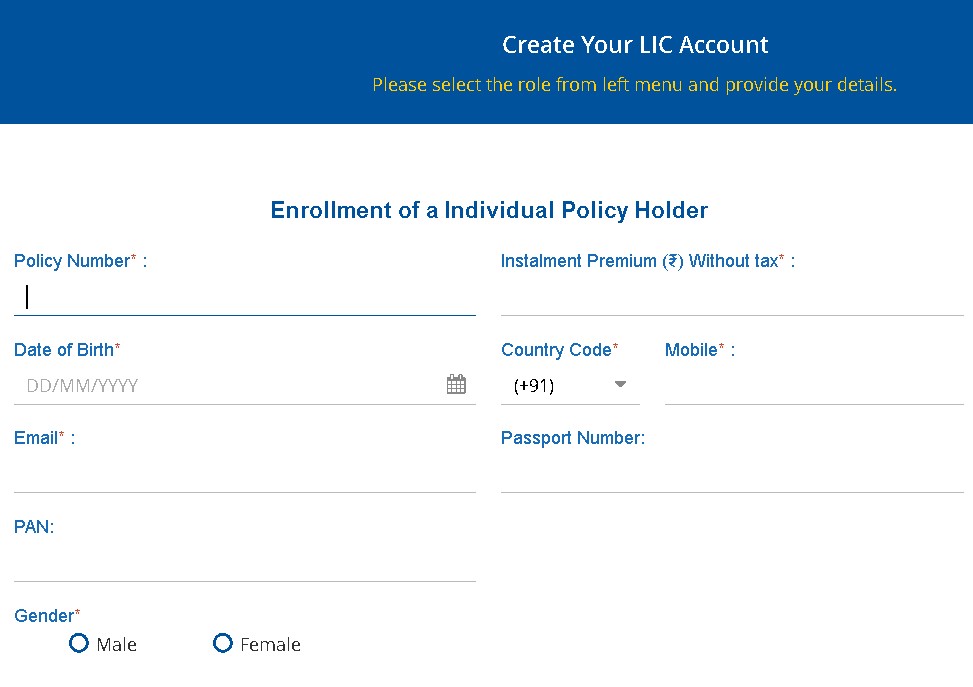

- They should fill up the details and upload the necessary documents, such as proof of identity, address, and age proof.

- Once the application is submitted, LIC will verify the documents and process the application.

- Policyholders can also pay the premium online through the website or app using a debit card, credit card, or net banking.

- It is important to note that individuals need to carefully read the terms and conditions of the pension scheme before applying and understand its features, benefits, and associated charges. They should also compare the various pension plans offered by LIC and choose the one that suits their needs and financial goals.

About LIC Pension Rate:

LIC Pension Rate refers to the pension or annuity a policyholder will receive from LIC under its pension plans. The rate of pension offered by LIC varies based on the plan type, the policyholder’s age, the premium paid, and the pension option chosen. Currently, LIC has not published any specific rates for its pension plans.

When purchasing the policy, the pension rate is calculated based on the prevailing market conditions and interest rates. However, LIC has a history of providing competitive returns and guaranteed income to its policyholders under its pension plans.

What Is The Current LIC Pension Rate?

LIC Jeevan Shanti is one of the best pension plans available, which offers up to 11.68% of interest, which is the current rate, and gives a fixed guarantee for life.

Frequently Asked Questions:

A retirement plan offered by LIC provides policyholders with a regular pension or annuity.

Individuals can apply for the LIC Pension Scheme online and offline.

The minimum age to apply for the LIC Pension Scheme is 18 years, with no upper age limit.

Summing Up:

In conclusion, the LIC Pension Scheme offers individuals a secure and reliable way to plan for their retirement. With a range of pension plans, individuals can select the plan that best suits their needs and financial goals.

LIC offers competitive returns and guaranteed income under its pension plans, providing policyholders with peace of mind and financial security during their golden years. Applying for the LIC Saral Pension Plan is also easy, with online and offline options.

Overall, the LIC Pension Scheme is an excellent option for those looking to secure their future and enjoy a comfortable retirement.