Income Tax Login: Every taxpayer in India must be a registered user on the Income tax department website. Being a registered user, one can access previous years’ tax returns, e-verify the income tax returns, check refund status, etc.

Income Tax Login: IT Department Efiling Login Process

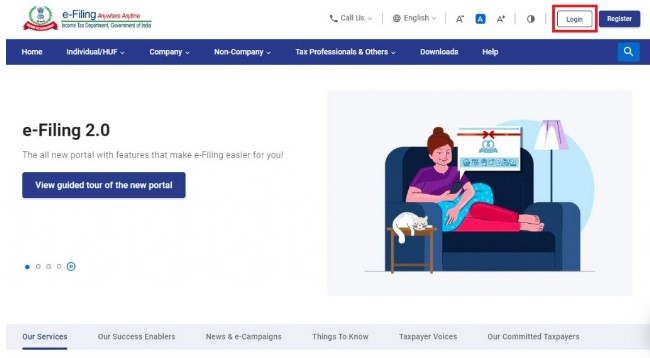

Step 1: Visit the income tax department homepage, i.e. https://incometaxindia.gov.in/.

To access the Indian income tax login page, visit the homepage of the government portal. Here, you will see a box on the top-right side with a ‘Login’ button for registered users.

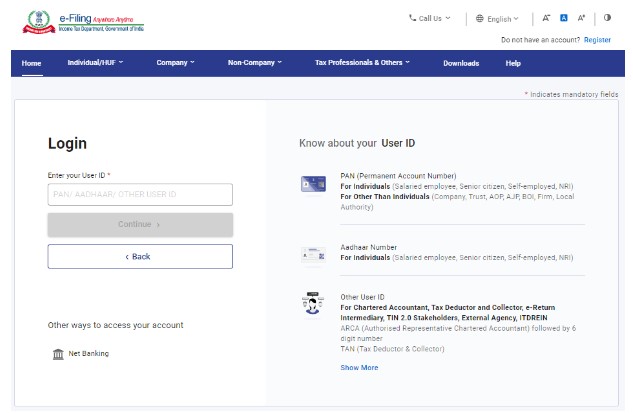

Step 2: Enter the required details asked for. Once you have clicked on that button, you will be taken to the login page, where you have to enter your income tax login username and continue to proceed further. Please note that the user ID is your PAN card number for income tax login.

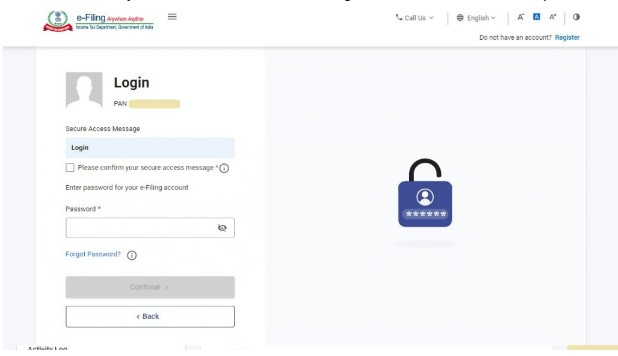

Step 3:Confirm the secure access message and enter a password. After proceeding further, confirm your secure access message and enter the correct password.

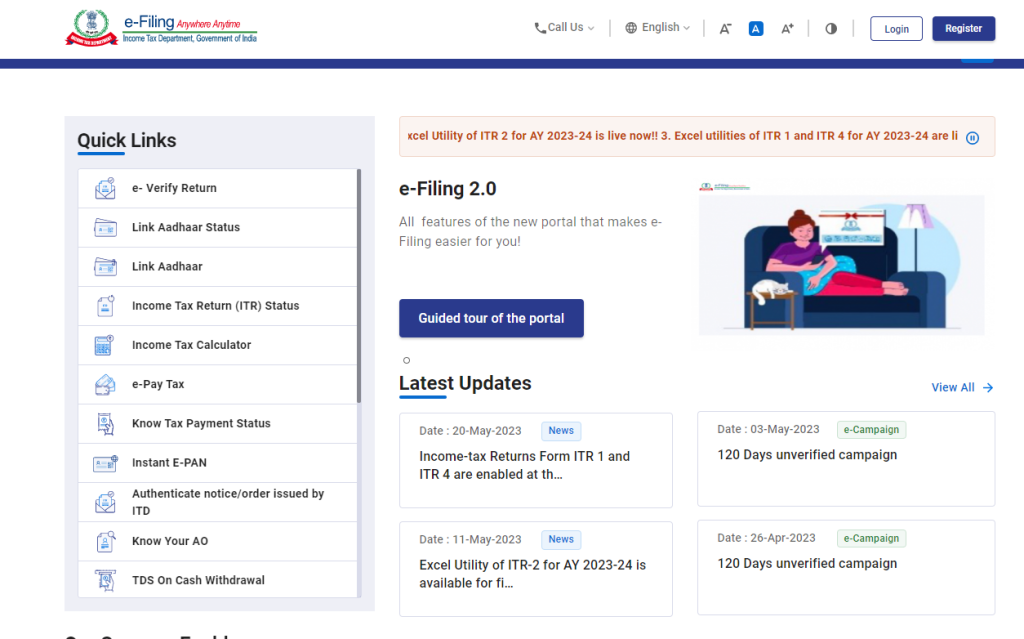

Step 4: Next, click skip, which will take you to the dashboard page. If you have yet to register! With the income tax portal, here is the process for registration

Prerequisite for Individuals to Register on Income Tax Portal:

Before registering on the income tax portal, one must ensure they have the following details:

- Valid PAN

- Valid Mobile Number

- Valid Current Address

- Valid Email Address, preferably your own

Minor criminals, or those barred by the Indian Contract Act of 1872, cannot register on the income tax portal.

Step-by-Step Process for Registering on the Income Tax Department Website

Step 1: Visit the Income tax department website/portal, i.e. https://www.incometax.gov.in/.

On the government portal’s homepage, click ‘Register’ on the right-hand side of the page.

Step 2: Enter your PAN. Enter PAN and click on validate. After that, select ‘Yes’ and click on ‘Continue’.

Step 3: Enter the Basic Details. Enter basic details such as first, middle, and last names. And select gender and residential status.

Step 4: Provide contact details

To complete the registration process, fill in the following details:

- Mobile number

- Email ID

- Postal address details

After correctly entering all the details, click on ‘Continue’.

Step 5: Verification. On submitting the form, a six-digit One Time Password (OTP) is sent to your mobile number and the email ID provided. Enter OTPs correctly to verify the details successfully.

Please note that in the case of non-residents, the OTP is only sent to the registered email address.

Step 6: Verify the details entered. After validating the OTP, you will get a new window to verify the entered details. If you want to make corrections, you can go back to the previous screen, make the necessary corrections, and validate the same with the OTPs received.

Step 7: Set password. After verification, set a password for your account and a secure login message. The password should be a combination of uppercase letters, lowercase letters, and special characters.

Step 8: Click on ‘Register’. After registering successfully, click the ‘Register’ button to receive an acknowledgement number.

How to login income tax without a password?

You can log in to the income tax e-filing portal with a password. However, you may consider clicking “forgot password” and resetting your password. You can choose to reset your password using any of the below three options:

- By receiving OTP on your mobile number registered with the income tax e-filing account or

- By receiving OTP on the mobile number registered with Aadhaar or

- By uploading your DSC.

What is the user ID of the income tax login?

The PAN number of the assessee is the user ID for income tax login.

The process to change registered mobile numbers in income tax without login:

- Log on to the income tax filing portal, ie.

- Then please go to ‘My profile’ by clicking on your profile image > contact.

- Then, click the edit button in the right-hand corner and change the mobile number.

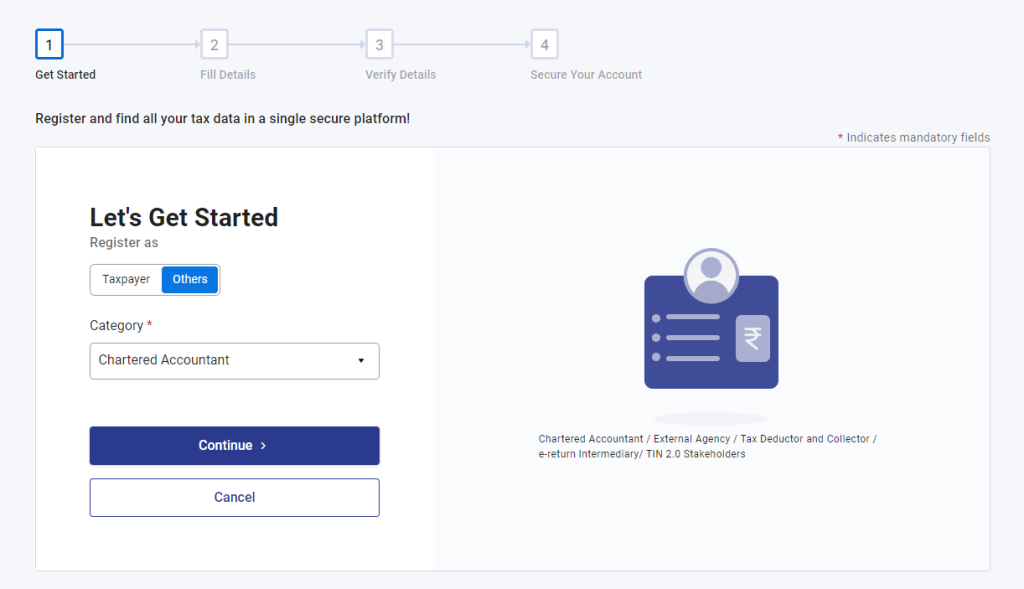

How to log in as CA on an income tax website?

- You can register as a chartered accountant and log in as a CA. To do the same, please log on to the income tax e-filing portal www.incometax.gov.in and select ‘Register’ from the top right corner of the home page.

- Click on the ‘Others’ tab and select the category ‘Chartered Accountant’ and click ‘Continue’.

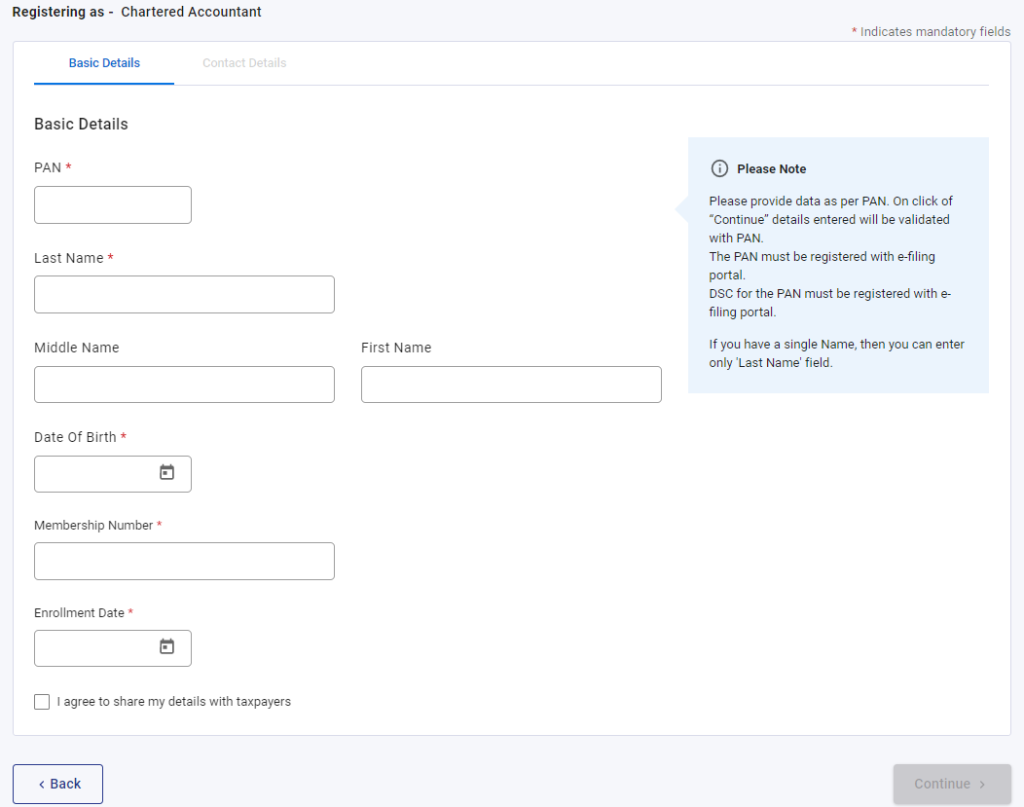

- A new window will ask you for details like membership number, enrollment date, PAN, name, and date of birth. On successful validation, the contact details page will appear.

- Enter all mandatory contact details such as mobile number, email ID, and address, and click on ‘Continue’. You will receive a six-digit OTP on your registered mobile number and email ID. Enter the OTP number received and click on ‘Continue’.

- Verify your details and confirm to proceed further. On the next page, you will be required to set your password.

- Set your password and click on ‘Register’. As a chartered accountant, your login ID would be the membership number, not your PAN number. Password would be as you choose as per the password policy.

What is RSA token no in income tax?

RSA token number, or request service acceptance, is a secure user authentication system. There is a need for a secured authentication system like an RSA token in an important department like income tax which maintains a comprehensive database of top taxpayers and wealth owners.

This token is given by the income tax department to its elected officers to maintain high security and confidentiality for taxpayers.

How to change my Name in my income tax?

The Income tax department uses the name available on your PAN card. Hence, you must change the name on your PAN card to change the name in the income tax records. It would be best to make a ‘name correction’ for PAN to change the name.

The process to register DSC in income tax login:

To register digital certificate, please follow the below-mentioned steps :

- The preliminary task before registering DSC is to go to the downloads tab in the menu bar and select the DSC management utility from the left pane.

- Download and install the emSigner utility.

- Plug the USB token and ensure that the DSC is active.

- Now log in to the e-filing portal, and go to ‘My Profile’ by clicking on your profile icon in the top-right.

- Your profile page will display a ‘Register DSC’ option in the left pane.

- Now enter the email ID linked with the DSC token and click on the check box ‘I have downloaded and installed emSigner utility’. And click on ‘Continue’.

- A new screen will appear; select the provider and certificate from the dropdown. And enter the provider password. Click on ‘Sign’.

- A success message will be displayed on successful validation.

Frequently Asked Questions:

To change your registered email address on the income tax portal, log in to your account and go to the profile settings. From there, you can update your email address to the new one.

You cannot access your spouse’s income tax returns using your login credentials. Each taxpayer must have a registered account to access their tax-related information.

You can update your bank account details on the income tax login portal. After logging in, go to the profile settings and find the option to update your bank account information.

If you forget your income tax login username, you can click on the “Forgot Username” link on the login page. Follow the instructions to retrieve your username through the registered email address or mobile number.

To track the status of your rectification request on the income tax portal, log in to your account and navigate to the “My Account” section. Look for the option to track the rectification status and enter the relevant details to check the progress.

Wrapping Up

An income tax is a tax on an individual’s income that the government imposes to generate revenue.

It is a crucial source of income for the government and helps fund various public services and development projects.

Therefore Income.Tax.gov.in is a user-friendly website that enables Indian taxpayers to easily file their income tax returns, make online payments, track refunds, and access various resources.