India’s Ministry of Road Transport and Highways has mandated FASTags for all cars. To ease congestion at toll plazas and promote cashless toll payments, FASTags were implemented. Commuters may save time using FASTags instead of stopping at the toll plaza to pay in cash.

22 banks in India have received certification from the Indian government to offer FASTag accounts to people. You may get FASTag services from HDFC, one of these 22 banks.

About FASTag:

To encourage quick and cashless transactions at toll plazas, India has deployed the electronic toll-collecting system FASTag. The National Highway Authority of India (NHAI) and the Ministry of Road Transport and Roads (MoRTH) have launched an effort to ease traffic congestion, save time, and encourage digital transactions on the nation’s roads.

With RFID technology, FASTag makes it possible for toll payments to be automatically deducted from the owner of the vehicle’s connected or prepaid bank account. It has a unique identifying number linked to the vehicle’s registration information and is attached to its windscreen.

toll plaza’s RFID scanner reads a FASTag-equipped vehicle’s tag as it approaches and immediately deducts the appropriate money from the connected account. There will be less waiting and more efficient overall because there is no longer a need for actual currency transactions.

The ease of FASTag is one of its main advantages. Owners of vehicles may readily obtain a FASTag from various authorized banks, online stores, and toll booths.

Users may reload the tag and manage their accounts online by connecting it to any active wallet or bank account. Individuals with various vehicles will find it helpful because multiple tags may be attached to a single charge.

FASTag is a significant step toward easing traffic congestion and enhancing highway travel times. Cashless transactions dramatically minimize the need for cars to stop and wait in long lines at toll plazas, resulting in a better traffic flow.

This saves travelers time and lowers fuel usage and car emissions, helping to create a better environment.

Therefore, FASTag has also increased toll collection accountability and transparency. The likelihood of corruption and revenue leakage at toll plazas has been significantly reduced thanks to real-time surveillance and automated transactions.

The system creates comprehensive reports and statements, enabling authorities to properly track toll collection and guarantee the correct use of revenues for road expansion and maintenance.

Where do I find HDFC FASTag?

There are two methods to purchase HDFC FASTag: Online and Offline.

Online Procedure:

To apply for an HDFC FASTag online, follow these easy steps:

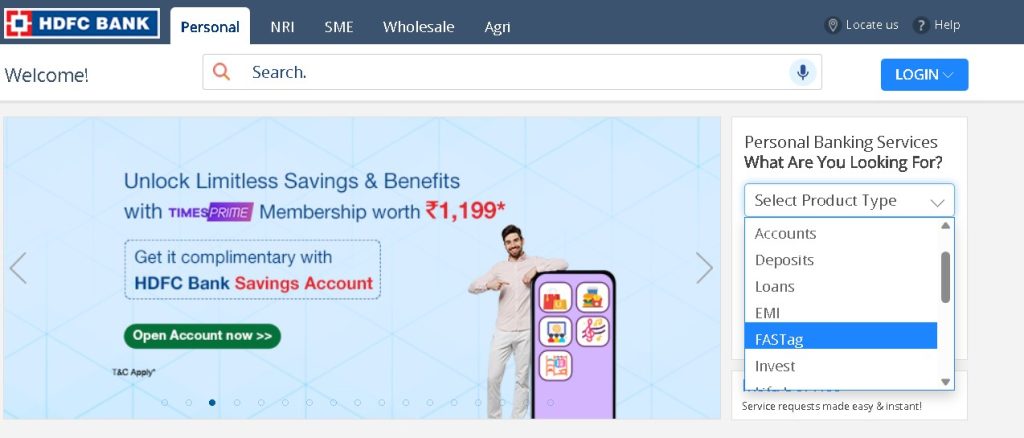

- Check out the HDFC website, i.e., https://www.hdfcbank.com/ or https://wwwhttps://v.hdfcbank.com/htdocs/common/fastag/index.html, where you can apply.

- From the ‘Personal Banking ServicesWhat Are You Looking For?’, choose FASTag.

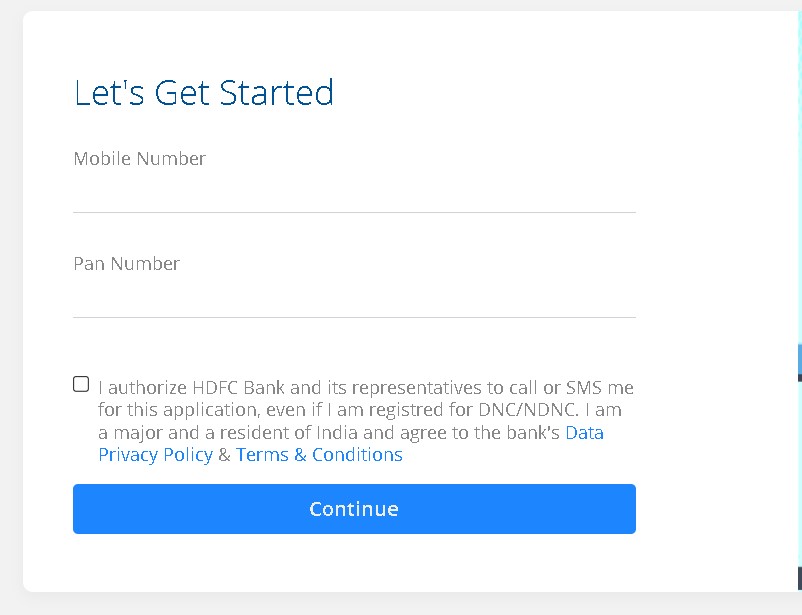

- Enter your registered mobile number and PAN Card Number.

- ‘Get a Free FASTag Now’ will display as a drop-down menu; select that option.

- Enter the precise location and vehicle information.

- Use any online payment option to pay the costs.

- Your FASTag will be delivered to the address you provided when you enrolled.

Note: To register, click this website link and register first. It is very accessible, as you need to fill in your required details https://fastag.hdfcbank.com/CustomerPortal/Login.

Offline Approach:

If you want to acquire your FASTag offline and be more comfortable with the online application process, please follow the guidelines below.

- Visit the HDFC location that is the closest to you.

- Ask questions about the FASTag.

- You must provide the executive with the necessary information and paperwork.

- After the HDFC FASTag expenses have been covered, you will receive your FASTag.

- Always keep a copy of your KYC and vehicle registration with you.

Note: HDFC FASTag services will allow you to use cashless toll booths. Scan your FASTag to save time and avoid the annoyance of queues during peak hours. If you still need to register your vehicle, save time and register it with FASTag right away.

Know About the Charges of HDFC FASTag:

There are several fees associated with various vehicle classifications. The issuance Amount, Associated Charges, and Reissue Fees are all included in this fee.

Issuance Amount: The Issuance Amount is the cost associated with the FASTag’s issuance. Each category’s FASTag issuance costs Rs. 100. The sum includes all relevant taxes.

The fees related to the HDFC FASTag recharge are shown under “Associated Charges.”

Reissue costs: You must pay the appropriate reissue costs for your vehicle type if you need a FASTag reissued due to damage, loss, or theft.

Here is the detail of the official table from the original website, i.e., https://www.hdfcbank.com/ that consists of all of the basic information about HDFC FASTag charges as per the commercial vehicle, so take a careful look below:

NPCI Vehicle Class | Description | Security Deposit (in Rs.) | Threshold Amount (in Rs.) |

4 | Car / Jeep / Van / Tata Ace and Similar mini Light Commercial Vehicle | 100 | 0 |

5 | Light Commercial vehicle 2-axle | 300 | 200 |

6 | Bus– 3 axle | 400 | 500 |

6 | Truck - 3 axle | 500 | 500 |

7 | Bus 2 axle / Minibus, Truck 2 axle | 400 | 500 |

12 | Tractor / Tractor with trailer, Truck 4, 5 & 6 -axle | 500 | 500 |

15 | Truck 7-axle and above | 500 | 500 |

16 | Earth Moving / Heavy Construction Machinery | 500 | 500 |

Terms & Conditions For FASTag Charges- HDFC:

- GST applies to all of the fees above.

- Minimal convenience costs may apply to online recharging. Use of a debit card or net banking incurs convenience costs of Rs. 8.00 per transaction, 1% of the transaction value for credit cards, and 1.10% of the transaction value for debit cards. There may be periodic changes to the fees.

- The fees above are subject to modification.

- The toll amount is withdrawn from the account depending on the vehicle class and the toll plaza utilized.

Online HDFC FASTag recharge possibilities are many.

How Can I Refill My HDFC FASTag?

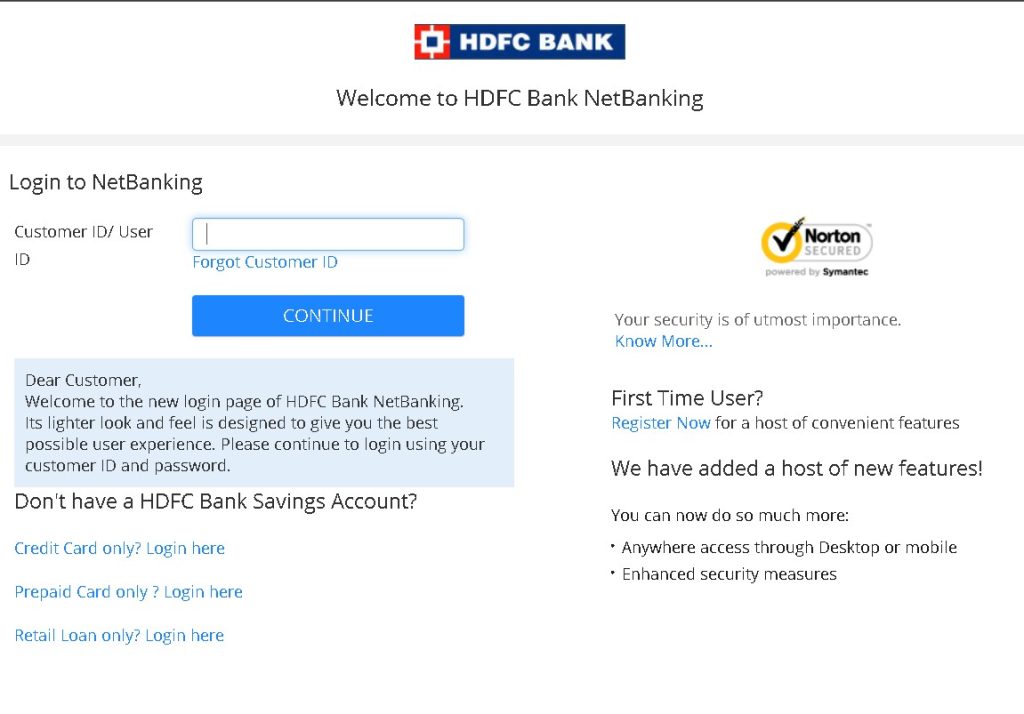

1. Via HDFC Bank Netbanking:

Follow these procedures to recharge your HDFC Bank FASTag using HDFC Bank NetBanking:

- Step 1: Open an account with HDFC Bank NetBanking. Choose the Continue tab from the “BillPay & Recharge” section.

- Step 2: Click on the FASTag symbol under “Pay.”

- Step 3: Choose HDFC Bank FASTag from the menu. After that, enter your wallet ID or vehicle registration number and select the Pay tab.

- Step 4: The maximum recharge amount, current wallet balance, and customer information like your name and vehicle registration number are shown on a screen.

- Step 5: Enter the recharge amount beneath the Payment Amount. The maximum recharge amount has a limit. Using Internet Banking and your HDFC Account, choose the payment method and finish your HDFC Bank FASTag transaction.

2. Google Pay:

- To use Google Pay to recharge your HDFC FASTag, connect your bank account to your FASTag ID on the app.

- Next, select Bill Payments > New Payment.

- From the list of FASTag issuing banks, choose HDFC.

- Complete the transaction by entering the recharge amount.

- Your recharging process was successful.

3. PhonePe:

- Launch the PhonePe app.

- Choose the ‘FASTag Recharge’ option from the ‘Recharge & Bill Payments’ menu.

- From the list of FASTag issuing banks, choose HDFC.

- Complete the transaction by entering the recharge amount.

- Your recharging process was successful.

4. Paytm:

- Access the Paytm app.

- From the ‘All Service’ tab, select ‘Recharge & Bill Payments.’

- ‘FASTag Recharge’ should be chosen from the menu.

- From the list of FASTag issuing banks, choose HDFC.

- Insert the FASTag number here.

- Pay for the HDFC FASTag by inputting the recharge amount.

- Your recharging process was successful.

Customer Service For HDFC FASTag:

To help you with any issues, HDFC has a customer support agent accessible 24 hours a day, seven days a week.

HDFC FASTag customer care may be reached at 1860-267-6161, a toll-free number. You can contact fastagdisputes@hdfcbank.com with your query.

Frequently Asked Questions:

A: The NETC FASTag is a device that accepts toll payments by Radio Frequency Identification (RFID) technology from the associated prepaid account. You may drive through any toll plaza with it attached to your car’s windscreen, eliminating the need to stop and exchange currency.

A: Here are some advantages that NETC FASTag provides:

-No toll plaza requires you to stop for cash transactions.

-The tag may be refilled online with a credit card, debit card, PayZapp, UPI, Net Banking, and mobile banking.

-You will be notified by SMS and email when there are toll transactions, your low balance, etc.

-Customers have a dedicated internet site where they may monitor transactions.

A: HDFC Bank FASTag is only available through online applications. Please click this link to access the application form: https://apply.hdfcbank.com/digital/fastag?mc_id=website_microsite_fastag&_ga

Or

To find out if the Over the Counter (OTC) FASTag feature is available, contact the HDFC Bank branch closest to you.

Wrapping Up:

In conclusion, HDFC Bank in India has developed HDFC FASTag into a practical and dependable electronic toll collection system.

Because of its simple accessibility, seamless integration, and effective toll payment system, HDFC FASTag has made a great contribution to speeding up digital transactions on roads, easing traffic congestion, and lower congestion. Due to its effective deployment, many car owners now prefer it, allowing for hassle-free travel.