Greater Warangal Municipal Corporation (GWMC) is the website that citizens of Warangal, Telangana, should use to pay their property taxes. As the administrative body responsible for Warangal, Telangana, the authority makes it easy to pay GWMC House Tax Payment through its website. This means you can avoid the hassle of visiting the tax office physically.

Using the GWMC website, you can pay your property tax online, making it more convenient. In addition, you can quickly check other relevant GWMC house details, including your GWMC property tax dues and application status.

The website also offers detailed information on the payment process, including guidelines on the mode of payment and the documents required. This helps to make the process hassle-free and easy to understand.

GWMC has designed its website to improve transparency and accessibility in tax payments. By leveraging technology, the authority makes it more convenient for citizens to fulfil their obligations. This will undoubtedly improve tax compliance and enhance revenue generation, leading to a better quality of life for the people of Warangal.

GWMC House Tax Payment Details Online Portal:

The GWMC portal’s extensive features enable property owners to make tax payments, access different applications, and more. Let us look at the features of this online portal that make it a popular destination among GWMC residents.

- Online Tax Services: One of the main features of the GWMC Property Tax portal is that it offers online tax services to property owners. This service includes paying taxes for the property, advertisements, water charges, and other property-related taxes. All you have to do is visit the website, fill in the required information, and pay the taxes in just a few clicks.

- Quick Links: The website has a separate section for quick links to various government portals, including the Ministry of Housing and Urban Affairs, the Directorate of Local Bodies, and more. These quick links make it easy for property owners to access relevant government websites without searching multiple pages.

- Online Applications: Besides the quick links, the GWMC Property Tax portal offers online applications for a trade license, assessment, license, and more. This feature helps property owners complete the required applications without visiting any government offices physically.

- Easy Navigation: Another standout feature of the GWMC Property Tax portal is its easy navigation options. All the services available on the website are just a few clicks away for visitors. The user-friendly interface allows you to navigate and find all the services effortlessly.

- Downloads: The portal also offers various download links that make it easier for property owners to access their preferred applications. You can easily download all the relevant applications related to property taxes and other services from the portal.

How to Make GWMC House Tax Payment Online in Warangal?

The Greater Warangal Municipal Corporation (GWMC) provides the convenience of paying property taxes online, allowing property owners to pay their taxes quickly and easily. Below are the steps you must follow when making GWMC House Tax Payment.

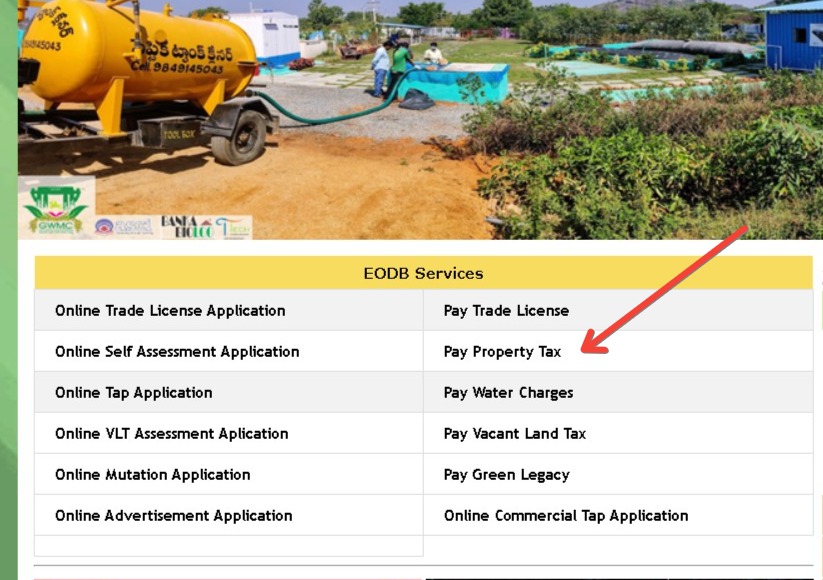

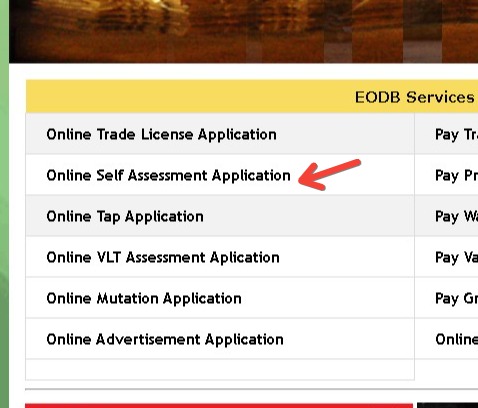

- To start the payment procedure, visit the official website of the GWMC property tax. Scroll down to find the list of EDOB Services and select the Pay Property Tax option available in the list.

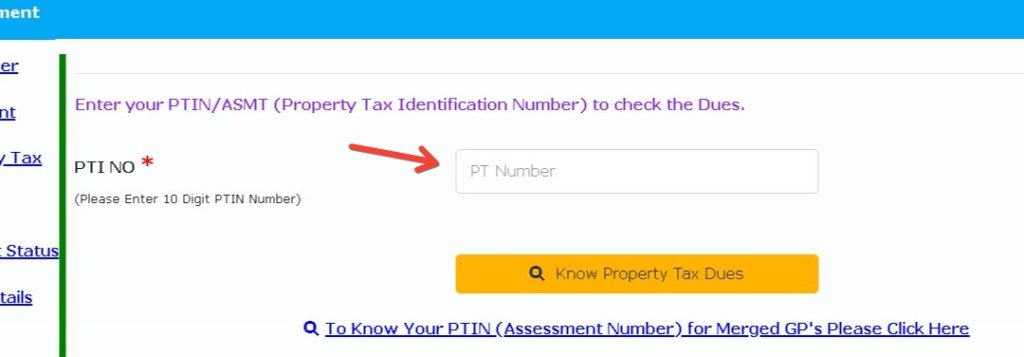

- Once you have accessed the portal, you will be prompted to provide necessary details such as your assessment or house number. These details are essential for quickly locating your GWMC property tax information.

- Once you have entered the necessary details, you will be directed to the next page to find your GWMC property tax details. You can find the appropriate link to make the tax payment.

- After clicking on the payment link, the portal will direct you to the next page, where you can verify your GWMC property tax details before making the payment.

- Once you have confirmed all your GWMC property tax details, you can proceed with payment. The portal provides several payment options such as net banking, credit card, debit card, NEFT, RTGS, etc., making it convenient for you to choose your preferred payment mode.

Thus, making GWMC property tax payments online is easy and hassle-free. Just follow the above steps and enjoy the convenience of paying your property taxes online.

How to Calculate GWMC House Details Property Tax in Warangal?

Calculating GWMC property tax in Warangal, Telangana is a straightforward process that can be done with a few easy steps. By following the instructions below, you can easily estimate the amount you will need to pay in property taxes:

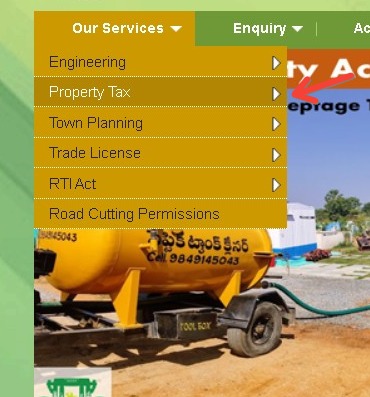

- Firstly, you need to visit the GWMC property tax website. Once you arrive at the homepage, go to the ‘Our Services’ dropdown menu, select the ‘Property Tax’ option, and click ‘Calculate Property Tax’.

- Secondly, you need to provide all of your GWMC property tax details. This includes information such as the house number, type of property usage, nature of construction, building age, and any other relevant information.

- Finally, once you have completed all the necessary details, click the ‘Submit’ button to calculate your estimated GWMC property tax amount.

By following these three simple steps, you can accurately calculate your property tax in Warangal.

How to Check GWMC House Details Tax Application Status?

If you have recently applied for GWMC Property Tax, you may be wondering about the status of your application. To help you out, here is a simple guide on how to check the status of your GWMC Property Tax application.

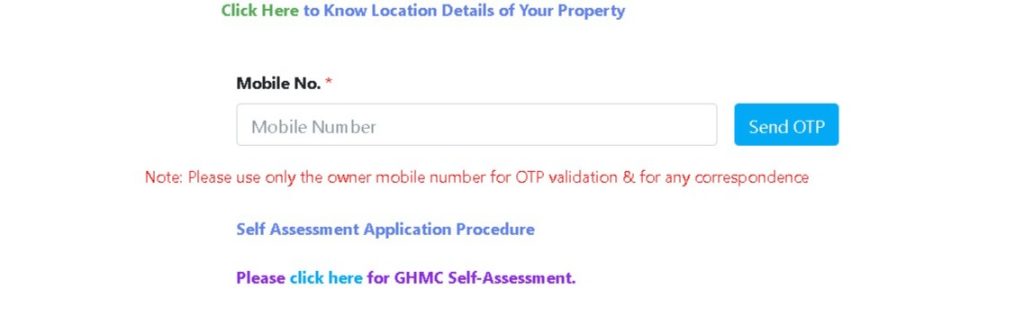

- The first step is to visit the GWMC Property Tax website. Once you are on the homepage, scroll down to the list of EDOB Services. Among the list of services, choose the Online Self Assessment Application option. This will take you to the page where you can proceed with the status check procedure.

- Next, you will need to provide the necessary details. On the page, you will see a list on the left side of the screen.

- Click on the Search Application Status button, and you will be redirected to the next page. You will see a space to input your application number on the right side of the page. Input your application number to proceed with the search.

- Finally, you can check the status of your GWMC Property Tax application. To do this, click on the Search Application Status button. You will then see the current status of your application. You will know where you stand with your property tax application, whether pending or approved.

How To Check GWMC House Tax Dues?

Are you a Warangal, Telangana resident and must check your GWMC property tax dues? Don’t worry. The process is simple and can be done online from the comfort of your home.

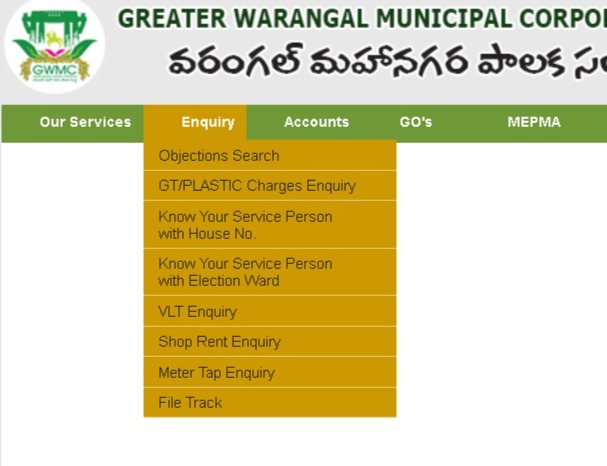

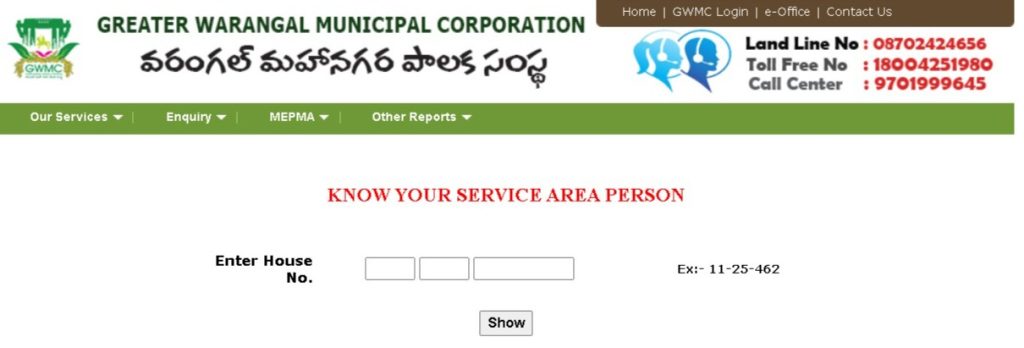

- To begin with, you need to visit the GWMC property tax website and navigate to the Enquiry tab at the top of the page. Select the ‘Know Your Service Person with house no’ option.

- Next, you will be prompted to provide basic details, such as your assessment or house number. This information is required to pull up your property details and provide you with an accurate assessment of your GWMC property tax dues.

- Once you have provided all the required information, you can click on the ‘Show’ button to get access to your GWMC property tax dues.

This hassle-free process is quick, efficient and can save you time. So, the next time you check your GWMC property tax dues, follow these easy steps and access the necessary information in just a few clicks!

Frequently Asked Questions:

A: You can download your property tax payment receipt from the website after payment.

A: You can access the GWMC Property Tax portal anytime.

A: Yes, you can use your credit card as a payment mode to quickly pay your GWMC property tax online.

Conclusion:

If you are looking for a reliable way to calculate and pay your property taxes, look no further than the GWMC property tax portal.

This service lets you easily calculate and pay your tax dues online. By taking advantage of this convenient service, you can save time and avoid late fees. To ensure that you make the most of this service, carefully evaluate your tax dues.

This will give you a better idea of how much you must pay and when. You can avoid any extra charges that may accrue by paying your property taxes in full and on time. This will help you stay on top of your finances and keep your property ownership in good standing.