A PAN card (Permanent Account Number) is a unique identification number issued by the Indian Income Tax Department to individuals and entities for tax purposes. A PAN card is mandatory for financial transactions, such as opening a bank account, investing in the stock market, filing tax returns, and more. A PAN card is a 10-digit alphanumeric code that serves as a unique identifier for the individual or entity.

In case of loss or damage, individuals can easily download a copy of their PAN card from the official website of the Income Tax Department. Downloading a PAN card is simple and can be completed online. To download a PAN card, individuals must provide their PAN number and other personal details and verify their identity through an OTP (One-Time Password) or biometric authentication.

Once the verification is complete, individuals can download a digital copy of their PAN card, which can be used for all financial transactions that require PAN card identification. Let’s learn more about Pan Card Download and other options in this article, so stay tuned till the end.

Key Features Of A Pan Card:

A PAN (Permanent Account Number) card is a unique identification number issued by the Indian Income Tax Department. Here are some key features of a PAN card:

- Unique Identification: PAN card is a 10-digit alphanumeric code that serves as a unique identification number for individuals and entities for tax purposes.

- Mandatory for Financial Transactions: PAN card is required for carrying out financial transactions, such as opening a bank account, investing in the stock market, buying/selling property, and more.

- Personal Information: PAN card contains personal information such as the cardholder’s name, date of birth, and photograph. This makes it a valid proof of identity for various purposes.

- Validity: Once issued, a PAN card is valid for the cardholder’s lifetime. However, any personal information or status changes must be updated with the Income Tax Department.

- Verification: PAN cards can be verified online through the Income Tax Department’s website. This allows individuals and entities to verify the authenticity of the PAN cardholder.

- Online Access: PAN cardholders can download a digital copy of their PAN card from the Income Tax Department’s website. This makes it convenient for individuals to access their PAN cards anytime and anywhere.

Overall, a PAN card is an essential document for financial transactions and valid proof of identity for individuals and entities in India.

Importance Of Pan Card:

PAN (Permanent Account Number) card is a crucial document for individuals and entities in India. It is mandatory for financial transactions and tax purposes and serves as valid proof of identity. It is required to claim government subsidies and benefits, conduct business transactions, and more.

It is essential to have a PAN card and keep it updated with the Income Tax Department to avoid legal complications. Therefore, a PAN card is also used for identification, which is why it is essential to have a PAN card.

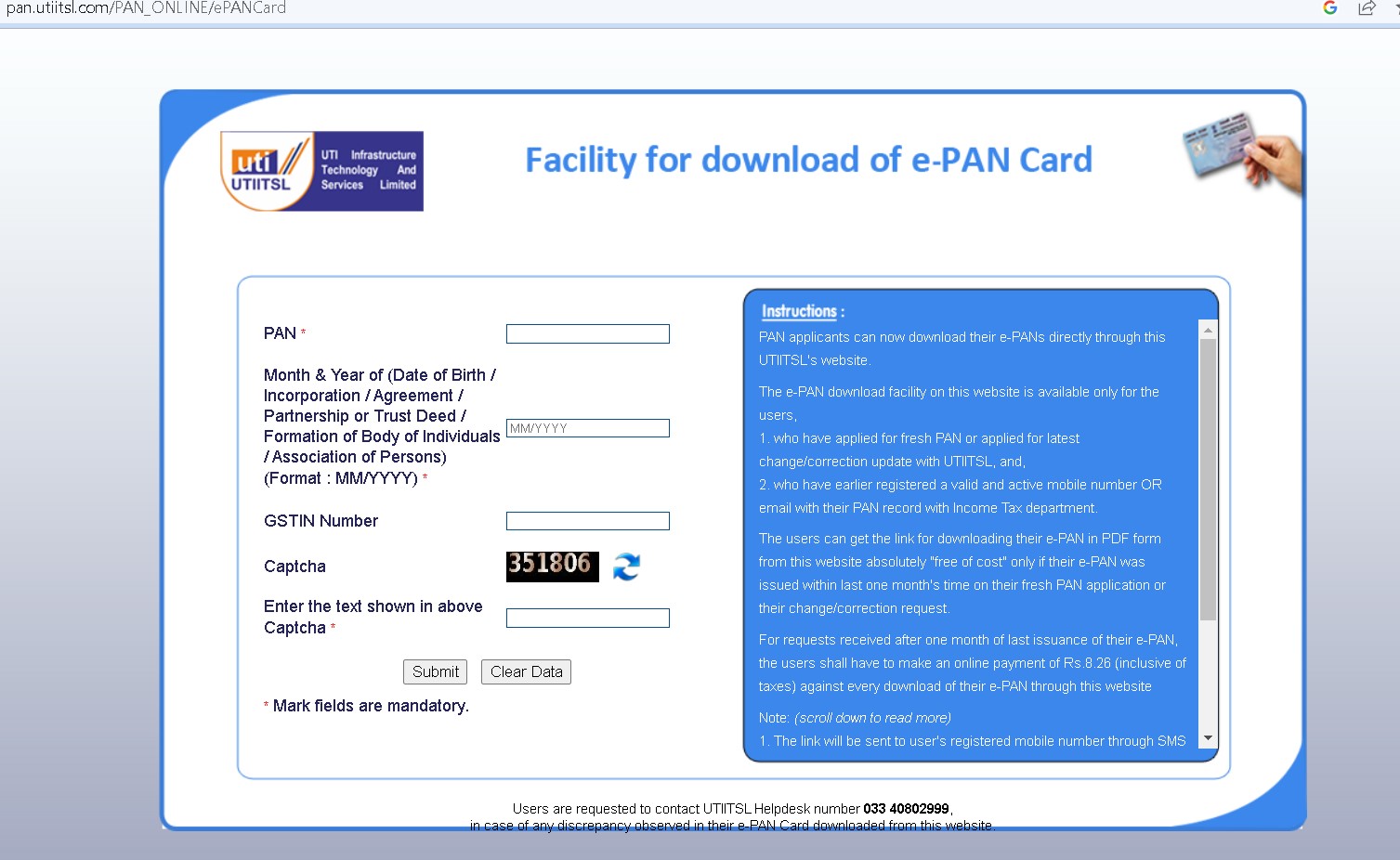

Steps To Download PAN Card On The UTIITSL Portal:

- Step 1: Head to the e-PAN portal of UTIITSL (https://www.pan.utiitsl.com/PAN_ONLINE/ePANCard).

- Step 2: Enter the PAN number, date, GSTIN number, and captcha, and proceed to submit.

- Step 3: Enter the OTP sent to the registered mobile number, email, or both.

- Step 4: If the PAN issuance period is over 30 days, the user will be directed to a new page to make an online payment of ₹8.26.

- Step 5: Now, you can download the ePAN.

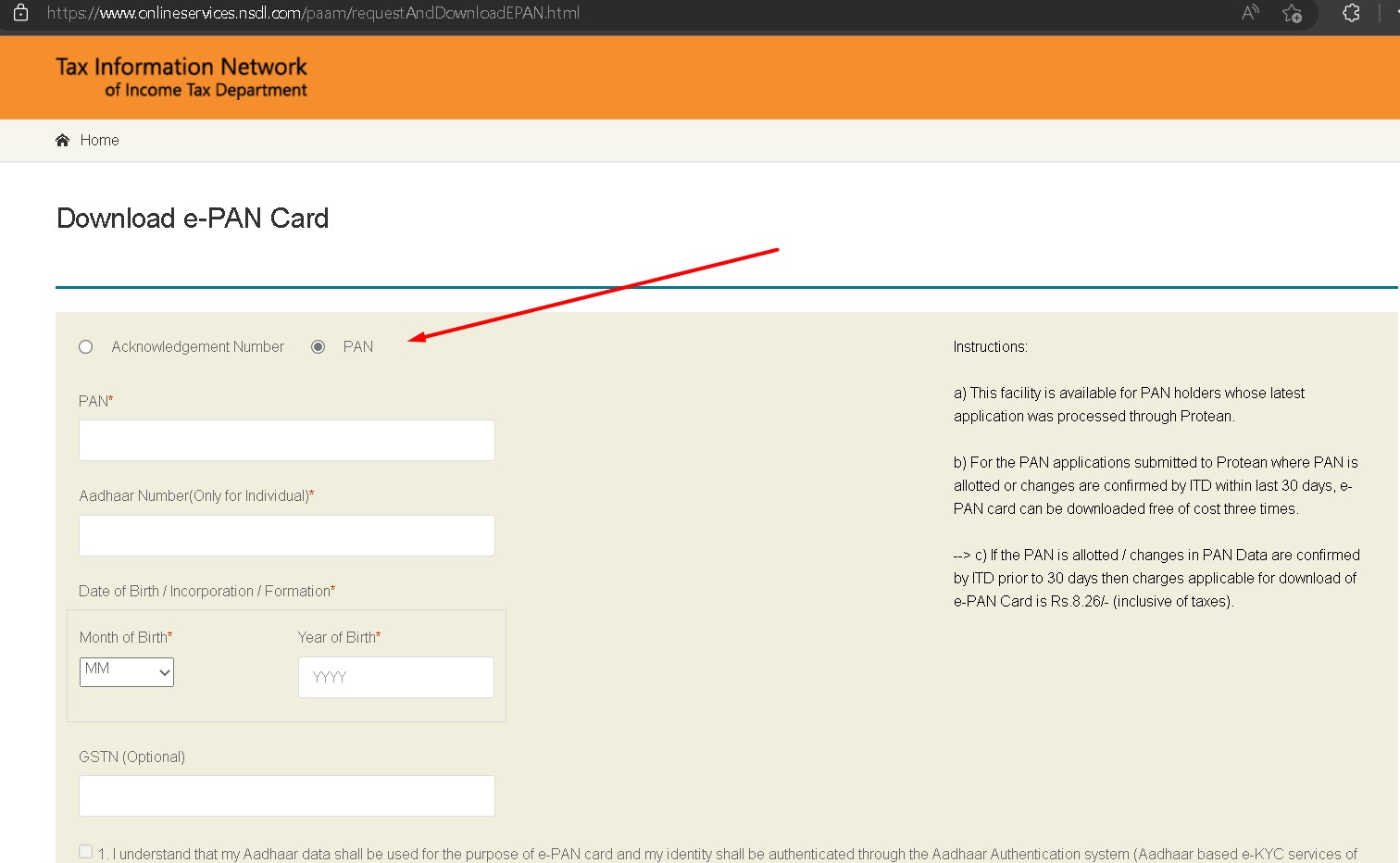

Steps To Download e-PAN From The NSDL Portal:

Here are the steps and a screenshot to download E-PAN from NSDL official portal. Take a look at it carefully for a better understanding.

- Step 1: Go to the NSDL e-PAN card download page.

- Step 2: Click to choose either using the PAN or acknowledgement number.

- Step 3: Using PAN Number details: Enter the details as required, along with the captcha.

- Step 4: Click to submit.

- Step 5: Your PAN card will appear on the screen i.e., Pan card download status. Click to download it in PDF format.

From the above process, you can download your e-PAN from NSDL easily.

The E-PAN Download Service:

Here are The details of the E-PAN card download service as follows.

- The facility is only available to PAN holders whose most recent application was processed through the NSDL e-Gov portal or the UTIITSL portal.

- The e-PAN card can be downloaded free of charge three times for PAN applications submitted to either of the portals where PAN is allotted, or ITD confirms changes within the last 30 days.

- If the PAN is assigned or changes in PAN data are confirmed by ITD before 30 days, the user must pay the applicable download charges to obtain their e-PAN.

- The downloaded e-PAN card’s PDF will be password protected. The user must enter their date of birth as the password to gain access.

How Do I Change Or Update My PAN Card Information?

- The applicant can update his or her PAN by going to the NSDL’s official website or the UTIITSL portal and selecting the Update PAN section.

- Then he must choose “correction” and update the necessary PAN card information.

- A copy of the address and identity proof documents are required to complete the requirement.

Frequently Asked Questions:

Users can apply for a new PAN card or submit change requests for their existing PAN card at either the NSDL e-services or the UTIITSL portal.

e-PAN is a digitally signed copy of your PAN card issued by the income tax department.

Yes, e-PAN is legitimate PAN proof. The e-PAN includes a QR code that contains demographic information about the PAN applicant, such as name, date of birth, and photograph. These details can be obtained using a QR code reader. In Notification No. 7 of 2018, dated December 27, 2018, the Principal Director General of Income-Tax recognised e-PAN.

A PAN card is valid for life once obtained. The PAN Card is unaffected by changes to an individual’s database. However, such changes must be reported to the Income Tax Department as ‘Request for New PAN/Correction in PAN.

Your e-PAN can be downloaded in PDF format and printed out.

Summing Up:

In conclusion, downloading a PAN card is a simple process that can be done online through the official website of the Income Tax Department of India. The process requires the PAN card holder to provide basic details such as their name, date of birth, and PAN number. Once the pieces are verified, the PAN card can be downloaded in PDF format.

It is essential to ensure that the details provided are accurate and match those on the PAN card to avoid errors in the download process.