Making your property tax online payment in Chhattisgarh Municipal Corporation is essential for property owners. This tax supports services like street lighting, road maintenance, and garbage collection that benefit the community.

However, navigating the complex tax payment process can be challenging, especially for beginners. Luckily, with https://cgsuda.com/, paying your property taxes in Chhattisgarh has never been easier. The platform is user-friendly and convenient, ideal for busy property owners who want to save time and avoid hassle.

This article is your ultimate guide on how to pay your property tax in Chhattisgarh Municipal Corporation. Whether you are a first-time taxpayer or an experienced property owner, you will find all the information you need here.

What is Chhattisgarh Property Tax?

You hold a crucial societal responsibility as a landowner or real estate owner of physical assets, including homes, offices, and other structures. You are expected to contribute your share to the government entities that uphold the communal welfare of society.

One such obligation is paying property taxes to the municipal corporation or panchayat, among other institutions.

In the Indian state of Chhattisgarh, every residential, commercial, or rental property owner must comply with Chhattisgarh property tax regulations.

It is essential to remember that this tax is due annually or semi-annually, depending on the individual’s convenience. As with other property tax requirements, the location of the property, its current valuation, and local laws all play a role in determining the tax amount.

How To Make property tax online Payments in Chhattisgarh?

Chhattisgarh residents can now quickly pay their property tax using the CGSUDA portal.

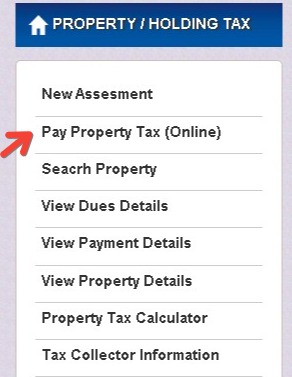

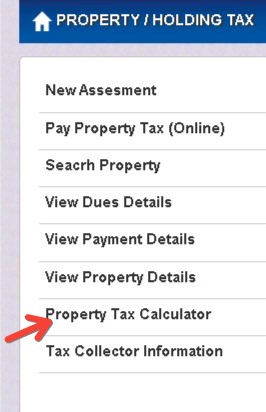

- To begin, the citizen should first visit the official website of Chhattisgarh Municipal. Select the “Pay Property Tax (Online)” option on the home page under the ‘Property/Holding Tax’ category.

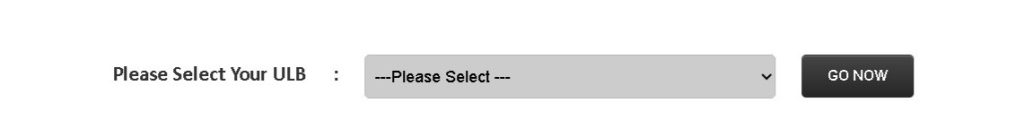

- Once selected, a page will open, prompting the user to choose their Urban Local Body (ULB). Click on the ‘Go Now’ option after making your selection. The search property page will then appear, providing options for selecting the Ward Number, Property ID, Application Number, or Owner Name.

- After entering the necessary details, click on the ‘Search’ button. A property list will then appear, allowing you to view the address, total area, owner information, and property tax details. Click ‘View payment details’ to check for previous property tax payments.

- To proceed with tax payment, click on ‘View demand details’ to review the details regarding the amount to be paid. After reviewing the bill details, click the “Pay Property Tax” option. The next page will show the property tax details and the payable amount. Click on ‘I Agree to Terms & Conditions’ before selecting the “Pay Now” option.

- You will be directed to a payment screen where you can select your preferred payment mode, such as credit card, debit card, net banking, and more. Fill in the necessary details in the appropriate fields before clicking “Pay Now” to complete your payment.

- Finally, an online receipt will be generated that you can download, save, and print for future reference.

With this easy step-by-step guide, paying property tax using the CGSUDA portal has never been easier for residents of Chhattisgarh.

How to Apply for New Assessment and Pay Chhattisgarh Property Tax using CGSUDA Portal?

Applying for a new assessment for Chhattisgarh property tax has been made convenient through the CGSUDA portal.

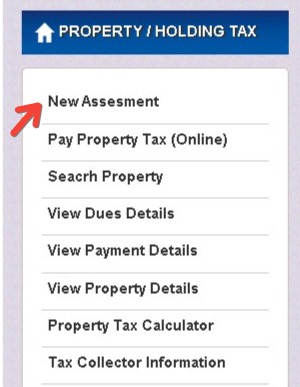

- To get started, you can visit the official website. Once there, scroll through the pages to find the Property/Holding Tax section. Click on the option New Assessment to be directed to another page.

- Here, you will see a list of the three ULB Municipal Corporations you can select from. Be sure to choose the Municipal Corporation where your property is located before clicking the “Go Now” button.

- You will be taken to the next page, where you must enter and submit your mobile number. An OTP will then be sent to you, which you need to verify before proceeding.

- Once you have successfully entered the OTP, you will be taken to the CGSUDA Property Tax New Assessment Online Form. Fill in the necessary details, verify everything, and click the “Submit” button.

By following these steps, you can conveniently apply for a new assessment for Chhattisgarh property tax through the CGSUDA portal.

How to Pay Property Tax in Chhattisgarh Offline?

Paying property tax in Chhattisgarh can be done through offline mode. Citizens who wish to pay property tax offline can follow these simple steps.

- Firstly, citizens can visit their local municipal office. Once at the municipal office, citizens must submit their Property Tax Challan or Property ID at the designated counter.

- Officials at the municipal office will then verify the citizens’ details. After this, they will provide payment details to the citizen. Citizens can then review the bill details and pay the tax amount accordingly.

- Once the payment has been made, the citizen will be provided with a payment receipt. This receipt is proof of payment and is essential to keep safe for future reference.

By following these easy steps, citizens in Chhattisgarh can make their property tax payments offline and without any hassles.

Chhattisgarh Property Tax Calculator:

In Chhattisgarh, the amount of property tax to be paid is determined based on the residential area and the property type. Property tax rates also differ between cities and localities. To make it easier for users to calculate the amount of property tax that they need to pay, the Chhattisgarh Municipal website provides a property tax calculator.

- To calculate property tax using this calculator, users must first go to the Chhattisgarh Municipal website and select the “Property Tax Calculator” option from the menu. Next, they must choose the appropriate Urban Local Body (ULB) from the list provided.

- Users must input specific information about their property on the following page. This includes property type, floor number, building type, usage kind, built-up area, zone, occupancy type, date, and other relevant information. After filling in all the necessary details, users can click the “Calculate” button.

- The calculator will then display the total amount of due property tax, including all applicable taxes and charges. This information is displayed on the next page of the website, providing users with an easy and convenient way to determine how much property tax they need to pay.

Documents Needed For Property Tax Online Payment In Chhattisgarh:

Are you looking to register for property tax in Chhattisgarh? Look no further than the CGSUDA Portal. You’ll need to provide a few documents to get started during the online registration process. Here’s what you’ll need:

1. A mobile number

2. An email id

3. An Aadhaar card

4. A Challan or Property ID, which serves as a unique identifier for the property

5. An Old Property ID, if you’ve previously paid tax on the property

6. The name of the property owner

7. The address of the property

Once you’ve received all these documents, you’re on your way to taking care of your property tax in Chhattisgarh.

Frequently Asked Questions:

Yes, you can choose a credit card as a payment mode while making your property tax payment online through the CGSUDA portal.

The CGSUDA portal accepts various payment modes, including credit cards, debit cards, and net banking.

Property taxes in Chhattisgarh can be due annually or semi-annually, depending on the convenience of the individual.

Yes, providing an Aadhaar card is required during the online registration for property tax payments in Chhattisgarh.

Yes, an online receipt will be generated after successful payment, which you can download, save, and print for future reference.

Wrapping Up:

If you want to make a difference in your Chhattisgarh community, consider using cgsuda.com for your tax payments. This platform will enable you to settle your taxes easily and empower you to pay on behalf of your fellow Chhattisgarh residents.

Plus, the beauty of digital payment means that the funds you contribute will be immediately allocated to the proper authorities rather than remaining stagnant in your bank account.

Take advantage of this incredible opportunity to give back, and rest easy knowing that your contributions are making a tangible impact. The team at cgsuda.com is here to support you every step of the way – don’t hesitate to reach out if you have any questions about the process!